A Comprehensive Guide to Retirement Savings: Understanding Makeup 401(k) Plans

Related Articles: A Comprehensive Guide to Retirement Savings: Understanding Makeup 401(k) Plans

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to A Comprehensive Guide to Retirement Savings: Understanding Makeup 401(k) Plans. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

A Comprehensive Guide to Retirement Savings: Understanding Makeup 401(k) Plans

In the realm of personal finance, retirement planning stands as a cornerstone for securing a comfortable future. A key component of this planning is the utilization of retirement savings vehicles, with the 401(k) plan being a widely popular option for employees. However, situations can arise where an individual may have a gap in their retirement savings due to factors such as job changes, career breaks, or simply insufficient contributions. This is where the concept of a "makeup 401(k)" comes into play, offering a valuable opportunity to bridge this gap and enhance retirement preparedness.

Delving into the Concept of Makeup 401(k)

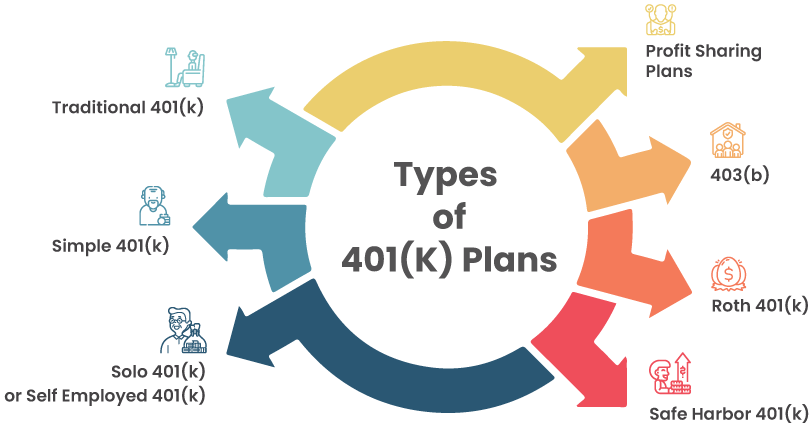

A makeup 401(k) refers to a strategy that allows individuals to catch up on their retirement savings contributions, particularly when they have missed out on contributions in previous years. This strategy is not a distinct plan type in itself but rather a method for maximizing contributions within an existing 401(k) plan.

Understanding the Mechanics of Makeup 401(k)

The mechanics of a makeup 401(k) hinge on the concept of "catch-up contributions." The IRS allows individuals aged 50 and above to contribute an additional amount to their 401(k) plans, over and above the regular contribution limit. This extra contribution limit, known as the catch-up contribution, helps older individuals accelerate their retirement savings.

While catch-up contributions are typically associated with individuals aged 50 and above, makeup 401(k) contributions can be made at any age, provided the individual has a valid reason for missing out on contributions in previous years. These reasons can include:

- Job changes: Frequent job changes can disrupt consistent contributions to a 401(k) plan.

- Career breaks: Individuals taking time off for family reasons, education, or other personal commitments might miss out on contributing to their 401(k).

- Insufficient contributions: Individuals might have contributed less than they could have due to financial constraints or lack of awareness about the importance of retirement savings.

The Importance of Makeup 401(k) for Retirement Planning

The importance of makeup 401(k) contributions lies in their potential to bridge the gap in retirement savings and bolster overall financial security. By catching up on missed contributions, individuals can:

- Increase their retirement nest egg: Makeup contributions directly contribute to building a larger retirement fund, allowing for a more comfortable retirement lifestyle.

- Offset the impact of inflation: Inflation erodes the purchasing power of savings over time. Makeup contributions can help counterbalance the effects of inflation and maintain the real value of retirement savings.

- Minimize the need for delayed retirement: A robust retirement fund allows individuals to retire when they choose, without the need to delay their retirement plans due to insufficient savings.

- Reduce reliance on Social Security: While Social Security plays a crucial role in retirement income, it is often insufficient to cover all expenses. Makeup 401(k) contributions can provide a supplementary income stream, reducing reliance on Social Security.

Eligibility and Contribution Limits for Makeup 401(k)

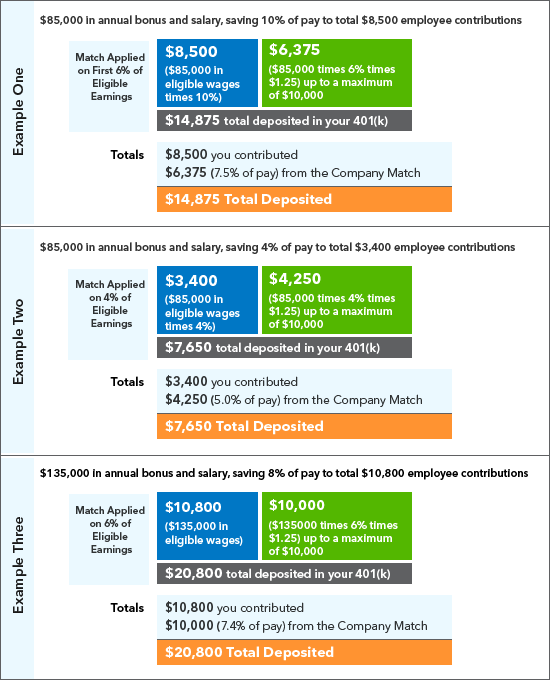

Eligibility for makeup 401(k) contributions is typically determined by the specific rules of the employer-sponsored 401(k) plan. However, the IRS does provide general guidelines regarding contribution limits:

- Catch-up contributions: Individuals aged 50 and above can contribute an additional amount to their 401(k) plan beyond the regular contribution limit. The catch-up contribution limit for 2023 is $7,500.

- Regular contribution limit: The regular contribution limit for 401(k) plans in 2023 is $22,500 for individuals under 50 and $30,000 for individuals aged 50 and above.

Tax Advantages of Makeup 401(k) Contributions

Like traditional 401(k) contributions, makeup contributions enjoy significant tax advantages:

- Tax-deferred growth: Earnings on contributions grow tax-deferred, meaning taxes are not paid until retirement.

- Tax-deductible contributions: Traditional 401(k) contributions are typically tax-deductible, reducing taxable income in the year of contribution.

How to Make Makeup 401(k) Contributions

The process for making makeup 401(k) contributions typically involves:

- Consulting with the plan administrator: Contact the administrator of your 401(k) plan to inquire about their specific rules and procedures for makeup contributions.

- Submitting a request: Submit a formal request to the plan administrator to make makeup contributions.

- Increasing your regular contributions: You can choose to increase your regular 401(k) contributions to make up for missed contributions.

- Making lump-sum contributions: In some cases, you might be able to make a lump-sum contribution to catch up on missed contributions.

FAQs about Makeup 401(k)

1. What are the tax implications of makeup 401(k) contributions?

Makeup 401(k) contributions are generally treated the same as regular 401(k) contributions for tax purposes. They are typically tax-deductible, meaning they reduce your taxable income in the year of contribution. However, you will pay taxes on the withdrawals during retirement.

2. Can I make makeup 401(k) contributions if I am no longer employed by the same company?

Generally, you cannot make makeup contributions to a former employer’s 401(k) plan once you are no longer employed by that company. However, you may have options to roll over your existing 401(k) balance into an IRA or a new employer’s 401(k) plan.

3. How do I know if my employer’s 401(k) plan allows for makeup contributions?

Review your employer’s 401(k) plan documents or contact the plan administrator to inquire about their policy on makeup contributions.

4. What if I missed contributions for a long period?

It is advisable to consult with a financial advisor to discuss strategies for catching up on missed contributions over a longer timeframe. They can help you develop a personalized plan to maximize your retirement savings.

5. Are there any penalties for making makeup contributions?

There are no specific penalties for making makeup contributions. However, you should be aware of the annual contribution limits for 401(k) plans, including catch-up contributions. Exceeding these limits can result in penalties.

Tips for Maximizing Makeup 401(k) Contributions

- Start early: The earlier you start making makeup contributions, the more time your savings have to grow.

- Consider a lump-sum contribution: If you have the financial means, a lump-sum contribution can significantly boost your retirement savings.

- Automate contributions: Set up automatic contributions to your 401(k) to ensure consistent savings.

- Seek professional advice: A financial advisor can provide personalized guidance on makeup contributions and overall retirement planning.

Conclusion

Makeup 401(k) contributions represent a valuable opportunity to enhance retirement savings and bridge gaps in contributions. By understanding the mechanics, eligibility requirements, and tax advantages of makeup contributions, individuals can make informed decisions to secure a more comfortable retirement. Remember, it is never too late to start catching up on missed contributions and building a robust retirement nest egg. Through proactive planning and strategic utilization of retirement savings vehicles, individuals can achieve their financial goals and enjoy a secure and fulfilling retirement.

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

Closure

Thus, we hope this article has provided valuable insights into A Comprehensive Guide to Retirement Savings: Understanding Makeup 401(k) Plans. We appreciate your attention to our article. See you in our next article!