Bridging the Gap: Understanding and Addressing Shortfalls in Financial Planning

Related Articles: Bridging the Gap: Understanding and Addressing Shortfalls in Financial Planning

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Bridging the Gap: Understanding and Addressing Shortfalls in Financial Planning. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Bridging the Gap: Understanding and Addressing Shortfalls in Financial Planning

%20(1).png)

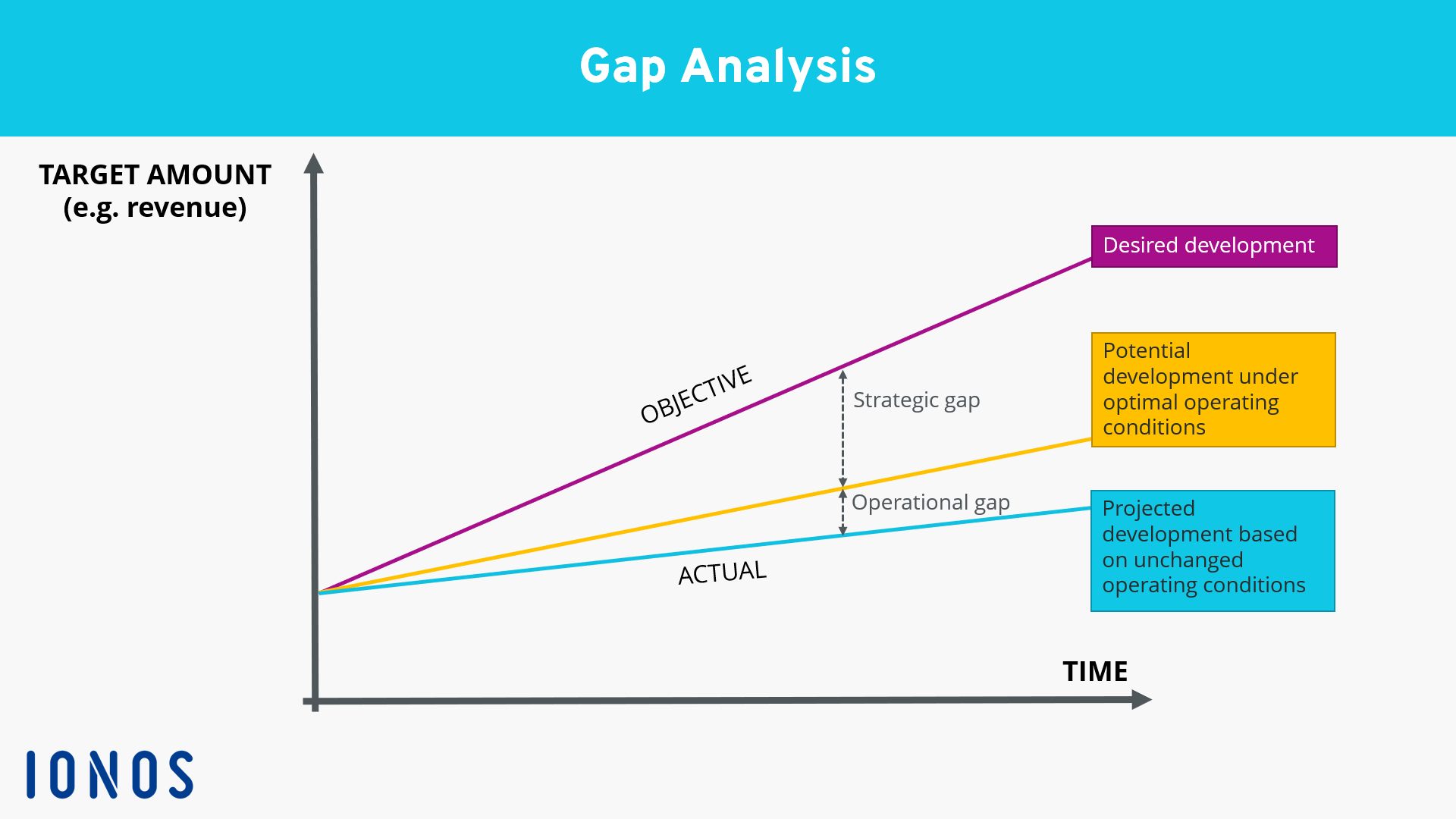

In the realm of financial planning, the concept of a shortfall is a critical element that demands careful consideration. A shortfall occurs when projected expenses exceed projected income over a specific timeframe, leading to a deficit in available funds. This discrepancy can arise from various factors, ranging from unexpected expenses to inadequate savings, and can have significant implications for individuals and organizations alike.

This article delves into the intricacies of shortfalls, exploring their causes, potential consequences, and effective strategies for addressing them. By understanding the nature of shortfalls and implementing appropriate measures, individuals and organizations can enhance their financial resilience and navigate unforeseen challenges with greater confidence.

The Anatomy of a Shortfall

Shortfalls can manifest in diverse scenarios, often arising from the following factors:

- Unforeseen Expenses: Unexpected medical bills, home repairs, or car breakdowns can disrupt carefully crafted financial plans, leading to a shortfall in available funds.

- Inadequate Savings: Insufficient savings can leave individuals vulnerable to financial shocks, as they lack a safety net to absorb unexpected expenses or income disruptions.

- Overestimation of Income: Overly optimistic projections of future income can create a false sense of financial security, leading to a shortfall when actual income falls short of expectations.

- Underestimation of Expenses: Failing to account for all potential expenses, such as inflation or rising costs of living, can result in a shortfall when actual spending exceeds projected amounts.

- Changes in Financial Circumstances: Job loss, retirement, or unexpected changes in family dynamics can significantly impact income and expenses, potentially creating a shortfall.

The Consequences of Shortfalls

The consequences of a shortfall can be multifaceted and far-reaching, depending on the magnitude of the deficit and the individual’s or organization’s financial situation. Some common consequences include:

- Debt Accumulation: When income falls short of expenses, individuals or organizations may resort to borrowing to cover the gap, leading to debt accumulation and increased financial strain.

- Delayed Financial Goals: Shortfalls can derail long-term financial goals, such as saving for retirement, purchasing a home, or funding education.

- Reduced Quality of Life: A shortfall can necessitate cuts in spending, potentially impacting living standards and quality of life.

- Stress and Anxiety: Financial insecurity and the constant worry of managing a shortfall can lead to stress, anxiety, and emotional distress.

- Business Failure: For organizations, a shortfall can lead to cash flow problems, impacting operations and potentially leading to business failure.

Strategies for Addressing Shortfalls

While shortfalls can be challenging, proactive strategies can help mitigate their impact and prevent them from spiraling out of control:

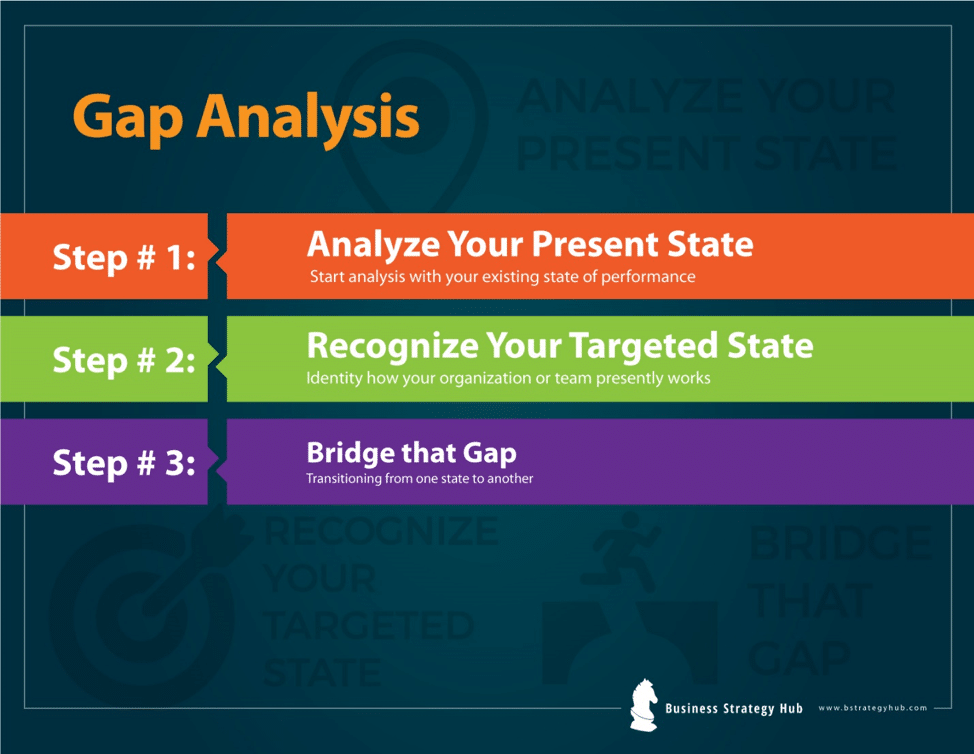

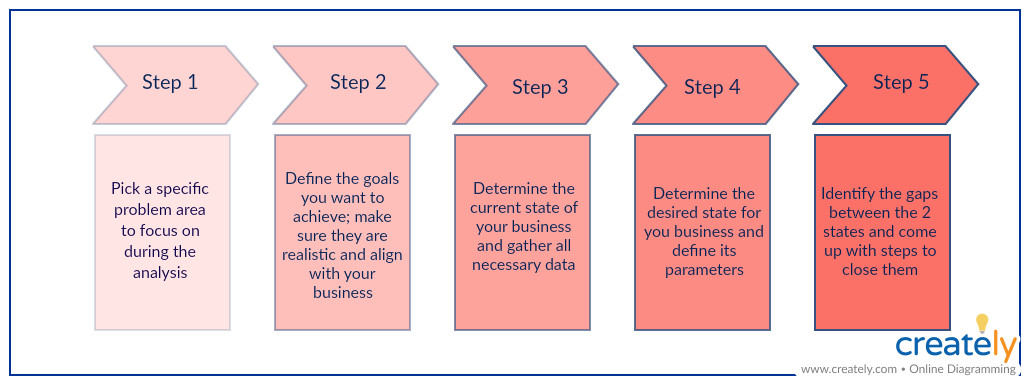

- Identify the Root Cause: Understanding the underlying reasons for the shortfall is crucial for developing effective solutions.

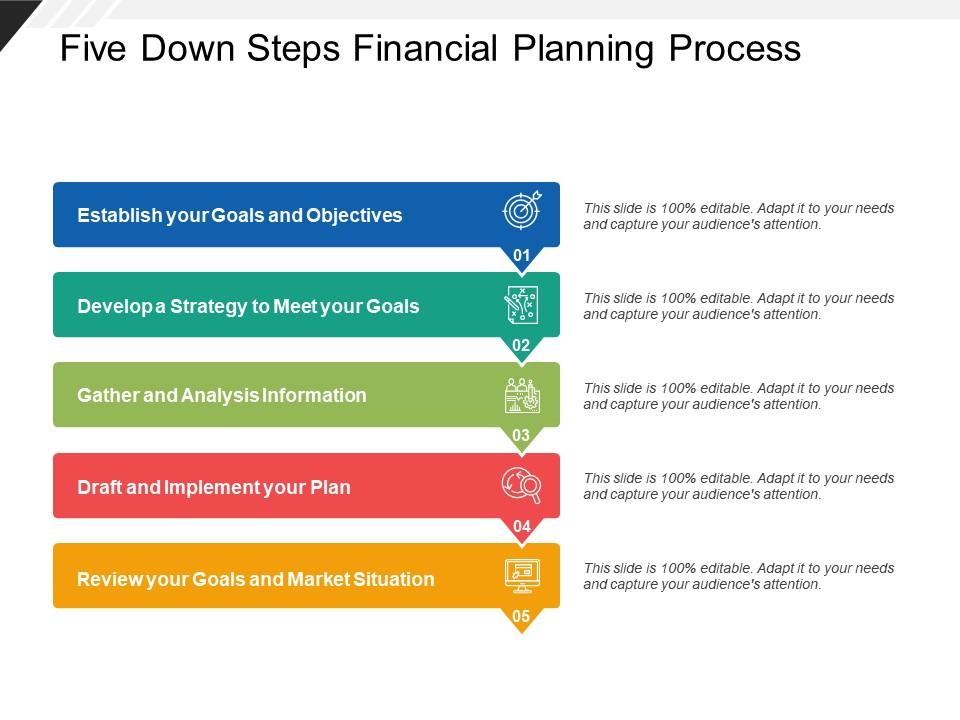

- Budgeting and Financial Planning: Creating a realistic budget that accounts for all expenses and potential contingencies is essential for preventing future shortfalls.

- Savings and Emergency Funds: Establishing a robust savings plan, including an emergency fund, provides a financial cushion to absorb unexpected expenses.

- Income Enhancement: Exploring opportunities to increase income, such as seeking a promotion, taking on a side hustle, or investing in skills development, can help bridge the gap.

- Expense Reduction: Identifying areas where spending can be reduced, such as cutting unnecessary subscriptions or finding cheaper alternatives, can help manage expenses more effectively.

- Debt Management: Developing a plan to manage existing debt, such as consolidating high-interest loans or negotiating lower interest rates, can free up funds to address shortfalls.

- Seeking Professional Advice: Consulting with a financial advisor can provide valuable guidance and support in developing a personalized plan to address shortfalls and achieve financial stability.

FAQs on Shortfalls

Q: How can I avoid shortfalls in my personal finances?

A: Developing a comprehensive budget, building an emergency fund, and regularly reviewing your financial plan are crucial for mitigating the risk of shortfalls.

Q: What are some common signs of a potential shortfall?

A: Signs include consistently using credit cards to cover expenses, having difficulty meeting monthly bills, and feeling financially stressed or anxious.

Q: What are some tips for managing shortfalls in a business?

A: Strategies include implementing cost-cutting measures, renegotiating contracts with suppliers, exploring alternative financing options, and seeking professional advice from financial experts.

Q: How can I overcome a shortfall in retirement savings?

A: Options include delaying retirement, increasing contributions to retirement accounts, exploring part-time work, or seeking professional financial advice.

Q: What are the long-term implications of ignoring a shortfall?

A: Ignoring a shortfall can lead to debt accumulation, financial instability, and difficulty achieving long-term financial goals.

Tips for Avoiding Shortfalls

- Regularly Review Your Budget: Make it a habit to review your budget at least quarterly to ensure it aligns with your current spending patterns and financial goals.

- Track Your Expenses: Use budgeting tools or apps to track your spending and identify areas where you can reduce expenses.

- Automate Savings: Set up automatic transfers from your checking account to your savings account to ensure consistent savings.

- Seek Professional Guidance: Don’t hesitate to consult with a financial advisor for personalized advice and support in managing your finances.

Conclusion

Shortfalls are a common challenge in financial planning, but they are not insurmountable. By understanding the causes and consequences of shortfalls and implementing proactive strategies to address them, individuals and organizations can enhance their financial resilience and achieve their financial goals. Regular budgeting, building an emergency fund, exploring income enhancement opportunities, and seeking professional advice are essential steps in mitigating the risks of shortfalls and achieving long-term financial stability.

Closure

Thus, we hope this article has provided valuable insights into Bridging the Gap: Understanding and Addressing Shortfalls in Financial Planning. We thank you for taking the time to read this article. See you in our next article!